Frequently asked questions

Certificate of Insurance for picking up loads

How do I Generate my Own Certificate of Insurance

To Generate your Own Certificate of Insurance follow these steps:

- Login to your account

- Add your Username & Password

- CLICK Login

Once you are in your Portal

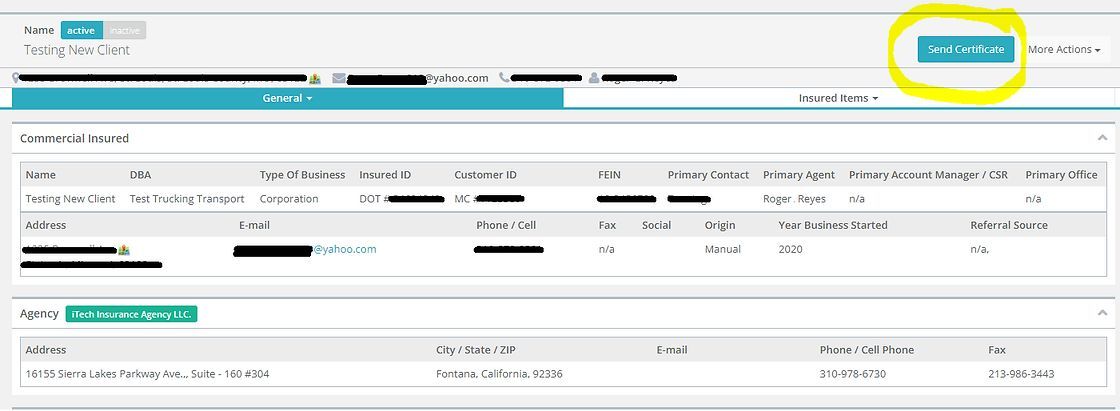

- CLICK "Send Certificate"

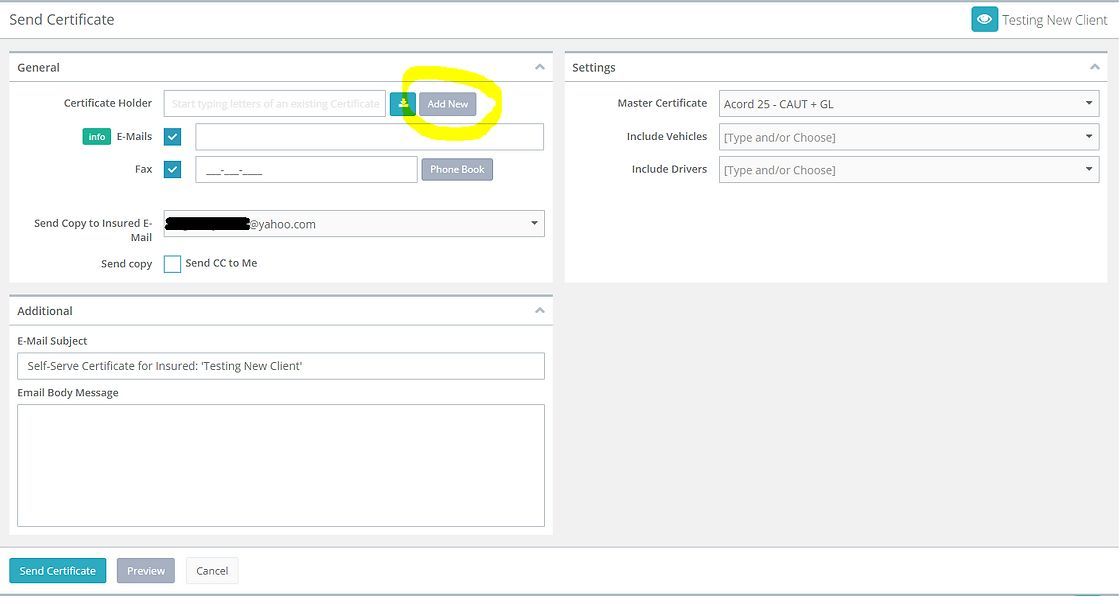

2. CLICK "Add New"

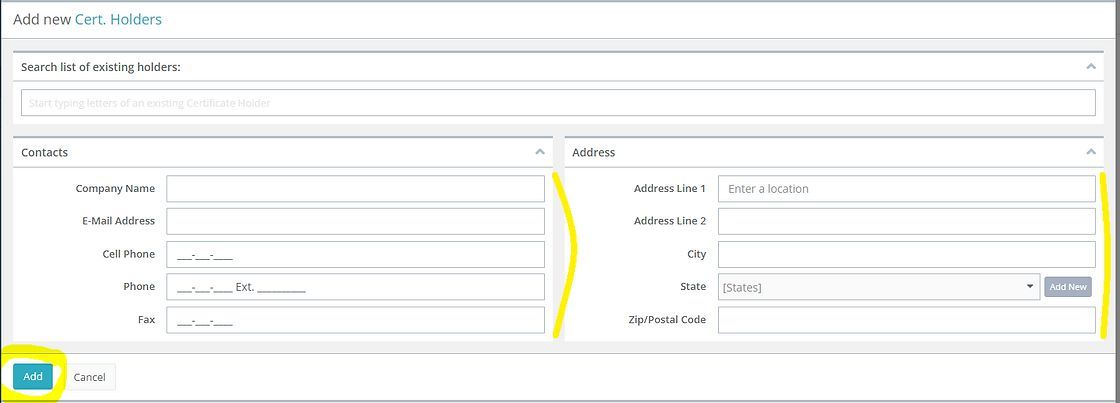

3. Input your Certificate Holder Information / CLICK "Add"

IMPORTANT NOTE - Add an Email

- This is how the Cert Holder will receive the Certificate of Insurance.

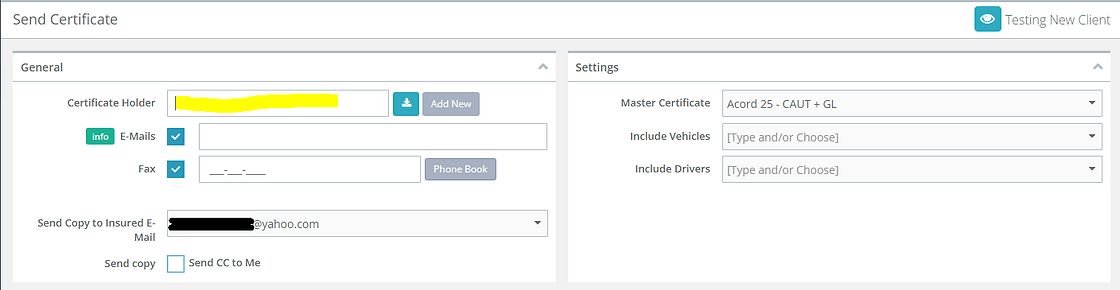

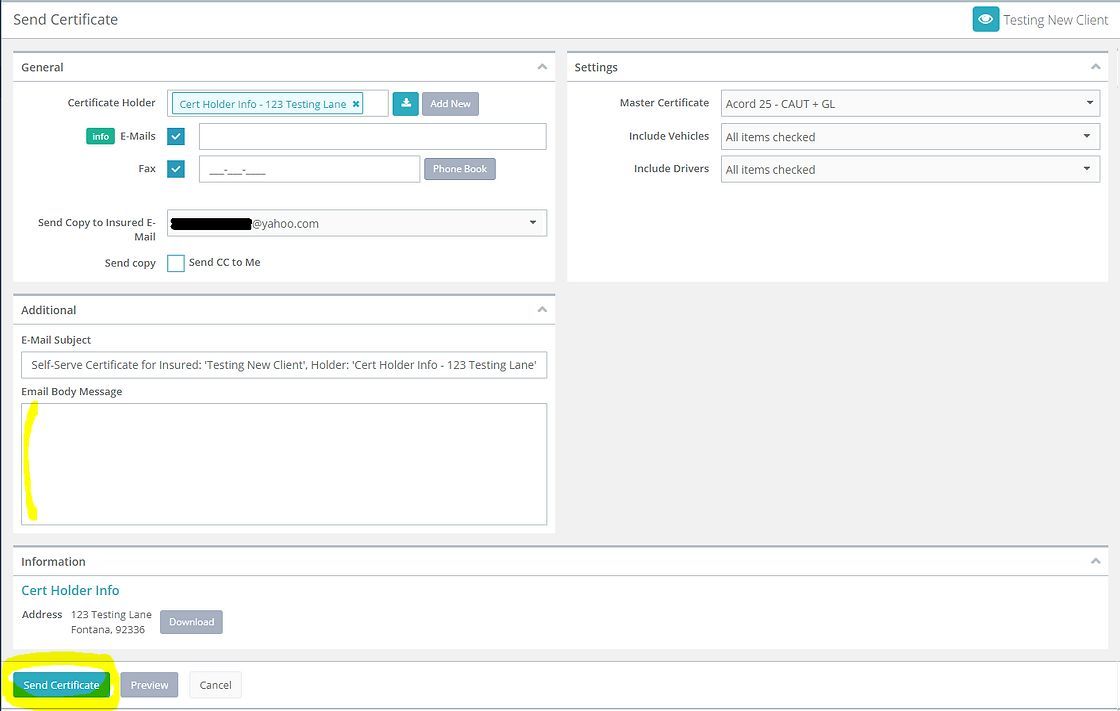

4. Type your Certificate Holder Name

- Choose the appropriate Certificate Holder

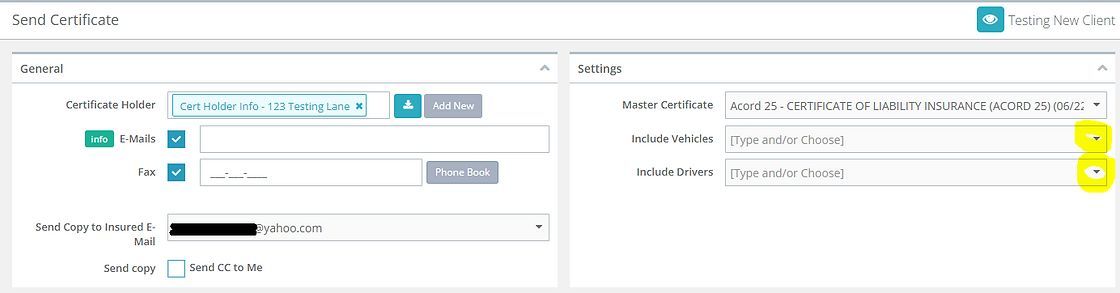

5. Choose "Vehicles" & "Drivers" you want to reflect on your Certificate

- Use the Dropdown Menu

6. CLICK "Send Certificate"

- Feel free to include a message in the body of the email if you wish.

- NOTE: you will receive a copy of the Certificate of Insurance in your email inbox, in addition to the Certificate Holder.

Always feel free to call in, or email your Certificate of Insurance request.

We are here for you!

Policy Types for the Trucking Industry

Commercial Auto Liability

Vehicle liability insurance provides protection in the event that you are responsible for an accident, offering coverage for two main aspects:

- Bodily injury: This coverage deals with injuries to the other driver. It includes payments for their medical bills, rehabilitation expenses, and other relevant costs from the accident for which you are considered liable.

- Property damage: This coverage pays for the costs of damage that your vehicle causes to other vehicles or property.

As a trucking company, you should to have the Standard, minimum coverage of $1,000,000, in CA to obtain your permits $750,000 is required.

Uninsured / Underinsured motorist

There are four types of uninsured/underinsured motorist coverages to protect your commercial drivers, depending on your state and choices:

- Uninsured Motorist Bodily Injury (UMBI): Covers injuries to you and your passengers if the at-fault driver lacks liability insurance, or if it's a hit-and-run.

- Underinsured Motorist Bodily Injury (UIMBI): Protects you and your passengers if the at-fault driver's insurance limits are insufficient to cover your injuries.

- Uninsured Motorist Property Damage (UMPD): Pays for repairing or replacing your vehicle if an uninsured driver damages it.

- Underinsured Motorist Property Damage (UIMPD): Pays for repairing or replacing your vehicle if a driver with inadequate coverage damages it.

Physical Damage

Provides protection for the physical damage to your own vehicles. It typically includes two main components:

- Collision Coverage: This covers damage to your commercial vehicles that results from collisions with other vehicles or objects, regardless of who is at fault. For example, if your delivery truck hits another car or a stationary object like a pole, collision coverage would help pay for the repairs.

- Comprehensive Coverage: This covers non-collision events that can cause damage to your vehicles, such as fire, theft, vandalism, hail, floods, and other natural disasters. Comprehensive coverage provides financial protection for a range of incidents that are not related to direct collisions.

CARGO - Motor Truck Cargo

Provides coverage for the goods or cargo that a commercial truck is transporting. This type of coverage is designed to protect the business owner or trucking company from financial losses in case the cargo being transported is damaged, lost, or stolen during transit.

Here are the main aspects that motor truck cargo insurance typically covers:

- Cargo Damage: Covers damage to the goods being transported caused by accidents, collisions, or other covered perils. This could include damage from accidents, fires, or other incidents that occur while the cargo is in transit.

- Cargo Theft: Protects against financial losses if the cargo is stolen during transport. This coverage is particularly important for businesses involved in transporting valuable or high-risk cargo.

- Debris Removal: Covers the cost of removing debris resulting from a covered loss, such as a cargo spill or damage.

Specific terms and conditions of motor truck cargo insurance can vary, so it's important for businesses to carefully review their policy and discuss coverage details with their insurance provider to ensure that their cargo is adequately protected during transportation.

General Liability Coverage

Provides coverage for bodily injury and property damage claims that may arise from the company's operations. Here are some key aspects that general liability insurance typically covers:

- Bodily Injury Liability: This coverage helps pay for medical expenses, legal fees, and other costs associated with injuries to third parties caused by the trucking company's operations.

- Property Damage Liability: Helps pay for the repair or replacement of property that is damaged as a result of the trucking company's operations. This could include damage to other vehicles, structures, or other types of property.

- Personal and Advertising Injury: Provides coverage for non-physical injuries, such as libel, slander, that may arise in the course of the trucking company's business operations.

- Products and Completed Operations: Protects against liability arising from products the company sells or the completion of work.

- Medical Payments: Covers medical expenses for injuries sustained by third parties on the trucking company's premises or as a result of its operations, regardless of fault.

Workers Compensation

Workers Compensation is mandated if you have an Employee(s) in California and many other States.

Workers' compensation insurance for a trucking company provides coverage for employees who are injured or become ill while on the job. Here are the key aspects that workers' compensation typically covers for a trucking company:

- Medical Expenses: Covers the cost of medical treatment for injuries or illnesses sustained by employees while performing job-related duties. This includes expenses such as hospital visits, surgeries, medications, and rehabilitation.

- Lost Wages: If an employee is unable to work due to a work-related injury or illness, workers' compensation provides partial replacement of lost wages. This typically covers a percentage of the employee's average weekly wage.

- Disability Benefits: Workers' compensation may provide disability benefits if an employee's injury or illness results in a temporary or permanent disability. The level of disability benefits depends on the severity and duration of the disability.

- Vocational Rehabilitation: In some cases, workers' compensation may cover the costs of vocational rehabilitation services to help an injured employee return to work or acquire new job skills.

- Death Benefits: If a work-related injury or illness results in the death of an employee, workers' compensation can provide death benefits to the employee's dependents. This typically includes funeral expenses and financial support for surviving family members.

It's important for trucking companies to carry workers' compensation insurance to comply with legal requirements and to provide financial protection for both the employees and the company in the event of work-related injuries or illnesses. The specific regulations and requirements for workers' compensation can vary by jurisdiction.

Truck and Roll Coverage.com